Galina Ostrikova, author of books on financial literacy, leading a private practice, and Anar Rzaev, an expert in creating IT startups and investments, will tell you how to properly manage a family budget.

Expert – Galina Ostrikova, author of books on financial literacy:

Everyone today understands the need to count their money, budget and save for the future. But not everyone knows and knows how to do this, because the traditional approach to balancing income and expenses does not give anything, but only aggravates the situation if the family does not have a very large income, if there is one or more children, if some family member does not work, if there are loans or mortgages, etc.

You can simply count your expenses and income to realize that your financial situation requires correction, requires changes that need to be made as soon as possible. Perhaps you can even find real ways to save within the existing budget, but what next, because no one has canceled inflation.

And based on the current prices for goods and services, the pile of money that you are trying to distribute by type of expense will run out very quickly, and you will realize that there is still not enough money for a lot of things, because it’s not about expenses, but about the ability to set up circulation of money in a single family.

I like this approach because it allows, firstly, to determine your levels of survival and prosperity in order to have a certain corridor within which you live and act, which shapes your security in a particular given period.

How to create a family budget

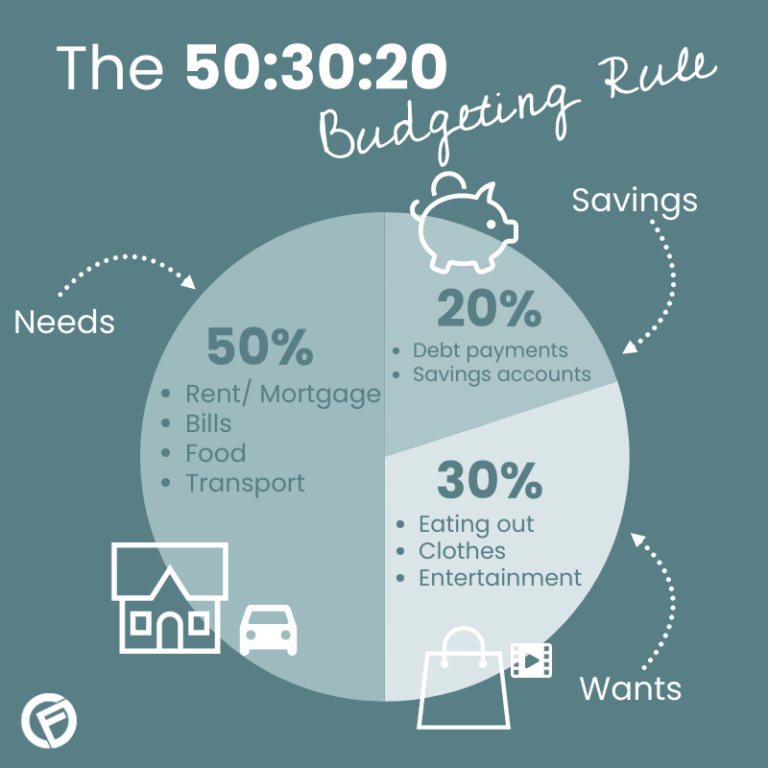

You switch from maintaining a total budget to a percentage budget, and then all your expenses will initially be distributed into four expense categories: food, apartment (housing), vacation, New Year gifts in the following proportions: 30, 30, 10, 30%. This is the case if you have no loans. If you have them, then the redistribution of interest within the budget occurs in accordance with 5 categories of expenses. And you start from a specific life situation.

The percentage of budget expenditures is a matter of the internal freedom of each individual, so there are huge opportunities for self-development and entrepreneurship.

Planning a family budget is not a question of distributing available resources, it is a task of organizing the circulation of money within the family. I have already spoken about this, and I will repeat it again, because it is important, because in the process of managing the family budget, you learn to form the necessary financial habits, not only your own, but also those of all family members, because we are all hostages of certain behavior patterns their parents, and mainly those who did not have a lot of money in circulation or other property.

Today this is even an advantage because we can use our creativity to live better. And the lack of free money can be an advantage.

We are often within the framework of an artificial shortage of money, and any shortage of resources only generates creativity. Let’s remember that in Soviet times, in the absence of resources, many curious and interesting things were created. But this is not what I wanted to say, although this is a very important point regarding money. Money is an idea, and the more ideas a person can find and apply, the more resources he has access to.

Let’s get back to creating good habits. You may already know this, but I believe that when it comes to managing a family budget, everything starts with a piggy bank, with a glass jar into which you start putting change. Transparency in all financial transactions is of utmost importance because people must learn to observe what is happening with our money, how the money pull factor works.

I understand that today many people hardly use cash, but if money is short, then “playing” with cash can give you the opportunity to simulate a new financial reality, because not only are you learning to perceive money on a physical level, but you are also and work with the nominal value and watch the money grow. In conditions where we are cut off from nature and its cycles, it is very difficult to understand what seasonal and other pleasures are.

The more free pleasures, the cheaper life costs us, the more we and our children understand the reality around us.

As part of the percentage budget, you also learn to separate the income and expenses of past periods of the family and the income of the current period, to understand that expenses of the current period should never depend on the income of the current period, and this is achieved only when you have learned to set up the circulation of money in the family, when know exactly the amount of daily working capital.

Probably, women do this most often, although I believe that we all constantly need to learn how to do this. After all, life is changing, what worked a few years ago no longer works today. For example, the transition to digital television in many regions of Russia – if you are not prepared for new types of expenses, you can be left without services that are important to you, etc.

The money process has its own “biochemistry”. The attitude with which you move money matters a lot because if you regret spending money, it won’t come back to you. And you need to be able to give and share money. That is why in my version of the percentage budget there is such an expense item as “New Year gifts”.

But I wouldn’t take this literally, because the whole point is that this expense item includes all your remaining expenses. If you learn to view them as gifts, there will be more joy in your life. In addition, within this category of expenses, we learn to build our needs and desires in a certain time period, and this triggers the time factor, because we do not need everything at once. And tomorrow the needs may even increase, not to mention the prices, which are still going up over time.

Types of family budget:

- Joint (the income of all family members is added to a common piggy bank and distributed among common expenses);

- Separate (each spouse pays common and joint expenses equally, for example, both husband and wife pay equally for kindergarten, apartment, food, etc., everyone spends the rest of their funds as they want ),

- Shared budget (everyone gives part of the pre-designated funds for general needs, and the remaining amount is spent on themselves).

What rules must be followed when managing a family budget

In addition to the generally accepted “pay yourself first”, namely: saving 10% of family money for the future, there are others. Although even this rule can be changed and taken to a completely different level: we can learn to actually pay ourselves a “salary” for everything we do in order to find other sources of motivation, because dependence on money, like a carrot for a donkey, begins over time irritate and turns life into a chain of the same type of actions, into a routine that does not please and does not develop.

In short, there is also the “golden ratio” rule for forming food supplies, for example, organizing the movement of food in the refrigerator, as well as the golden rules of family economics such as “nothing extra,” “nothing complicated,” “nothing special,” etc. because life with or without money should be easy.

But the most important rule, in my opinion, is “you cannot take someone else’s property without permission.” This is what our parents and school taught us in childhood, but it is this rule that is constantly violated in the reality around us and undermines the foundations of private property. After all, no one wants in life to be victims of Alice the Fox and Basilio the Cat from the children’s fairy tale about Pinocchio.

An example of budgeting from the life of one family

Expert – Anar Rzayev, expert on creating IT startups and investments:

Family budget is a fine line between newlyweds who have been married for no more than 5 years. At the time of the toast at weddings, the main instructions of elders and parents are: protect the family hearth, be tolerant, find compromises in difficult situations. When it comes to money, many people cannot get out of their comfort zone and start spending without thinking about the future.

I have been married for 10 years, I have a wonderful wife with whom we have gone through many difficult situations and 2 boys, ages 2 and 8 years. My wife, Albina, is on maternity leave, but earns money by selecting and selling tourist packages and issuing visas. In the past I had a travel agency, more than 8 years have passed. At the time when I was just starting out as an entrepreneur, it was difficult to pay salaries to managers, pay office rent and overhead expenses.

Therefore, Albina herself offered to help me, despite the birth of her first son, Rodion. I took courses in tourism at RUDN University, and little by little, as best I could, I taught my wife the basics of regional studies, selection and design of package tours. It was unusual to see my wife at work and at home, but we tried to maintain subordination. 8 years have passed, I sold the travel agency a long time ago, but Albina is still selling tours to her large client base. I don’t drive my wife to work; she is free to move and takes care of raising the children in my absence.

I’m not used to sitting in an office and developing my business areas, constantly testing new ideas and hypotheses, which take up to 15% of my monthly income, but it’s worth it, since I’m investing in the future of my family. Albina has never condemned my actions, and this does not affect family relationships in any way.

What is the saving of the family budget? We never take out loans, don’t pledge anything, we’d rather get by or save up for a major purchase (real estate, car). This is my personal decision, since being in debt to someone for something is not for me. Albina supports me in this. Up to 30% of income is spent on groceries and food, I won’t say that we don’t go to cafes and food courts – it happens, but not every day. Many young couples believe that having a child will cost a lot of money. Here’s how you look at it. You can dress your child in everything new, don’t buy things from expensive brands for him to grow up, and take him to play areas and a movie theater every day. In this vein, the costs are high. But it is possible to save both on clothes and on leisure time.