To better understand the category financial leverage it is necessary to more fully imagine the situation related to the activities of a particular company.

This condition is the starting point for the concept of resource planning, which is to direct a certain limited amount of funds specifically to purposes of primary importance. Of course, funds called the organizations’ own funds, as well as raised funds, will be sent there.

The presence of raised funds in the company’s resource planning is explained by the fact that, as a rule, the company does not have enough to implement more or less significant investment projects your own resources. In any case, the funds raised will help the company solve the problem of accumulating funds and, in general, more effectively implement a particular project.

The main sources of credit resources for any legal entity are bank loans, however, to attract them you need to follow a number of steps that will help lead to a positive result. These steps involve submitting an application to a credit institution along with other documents confirming the serious intentions and stability of the enterprise, then the bank will consider this application, analyze the documents submitted by the company from the point of view of the financial stability of the legal entity and make its decision. The bank’s decision may not always be positive, so in practice, an enterprise can apply to a fairly large number of banks to obtain a particular loan amount.

At the same time, an enterprise can choose alternative sources of attracting resources that are associated with the issue of various financial instruments. For example, an enterprise can announce an additional issue of company shares and attract investment capital using equity financial instruments, and it is also possible to use debt financial instruments. In this regard, the most often used instrument is the issue of bonds.

Taking into account the above, we come to the conclusion that the need to attract borrowed funds in various ways is possible and necessary to fulfill both tactical and strategic tasks. Thus, financial leverage is one of the tools for achieving goals.

To assess the use of financial leverage, the indicator of the effect of financial leverage is also used. To calculate the effect of financial leverage, additional quantities are used, such as the tax adjustment and the financial leverage differential.

The tax corrector allows you to more accurately calculate the impact of loan funds on the planned amount of profit, since the higher the tax, the less money remains for this particular company or organization, which means the less loan funds it can attract from various sources.

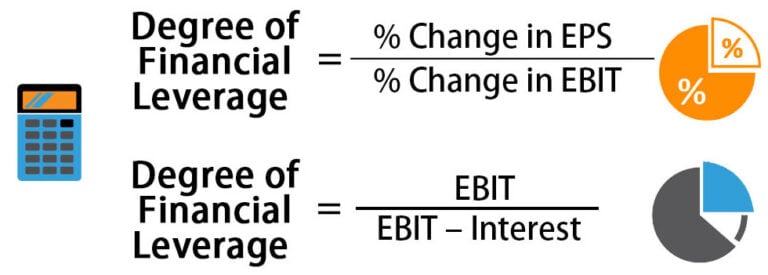

Calculation of financial leverage is necessary in order to compare the return on assets and the interest rate on the loan. The higher the difference between profitability and the loan rate, the more pronounced the positive effect from the use of loan funds will be.

To screen the value of the financial leverage differential, the following parameters are used: if the differential is less than zero, then the loan “eats up” too much of the company’s funds and leads to losses; if the differential is zero, then the profit is completely spent on paying interest on the loan and, finally, if the differential is greater than zero, the profit covers the loan payment in excess.