Any manager at a certain point in the operation of an enterprise is faced with the question of whether to consider a particular investment project or ignore it as unpromising.

- Implementation stage of the investment project

- Assessing the effectiveness of investment projects: plan, analysis, methods, main assessment indicators

- Risk assessment or pitfalls of investment projects

- Project management structure

- Sources of financing investment projects

- Interesting facts about investments

In order to make the right decision, it is necessary to study the issue from various perspectives and identify possible positive results or unforeseen risks in its implementation.

Implementation stage of the investment project

The implementation of an investment project is a solution to a certain range of tasks that are aimed at ensuring that the mechanism of a specific investment begins to function and bring economic benefits.

Experts identify the following tasks to be solved during the implementation of an investment project:

- Define the organizational and legal form – the project is being implemented on the basis of an existing organization or a new business entity is created for it;

- Determine the procedure for interaction with government agencies – in the event that the project will be implemented jointly with administrative centers or funds;

- Establish a circle of responsible persons – they will be responsible for the implementation of the project in reality, manage the full cycle of functioning of the investment business project and be responsible for the results obtained;

- Identify the material and technical base – identify the funds that will be used for the functioning of the investment direction being created;

- Determine the main economic characteristics or parameters – these include the rules for pricing products, the procedure for their sale on the market, methods of creating advertising, methods of competition with similar projects, etc.

Solving these problems makes it possible to create conditions for the effective implementation of investment projects in the economic environment, which implies obtaining certain benefits in the future.

Assessing the effectiveness of investment projects: plan, analysis, methods, main assessment indicators

As a rule, investments are made for a fairly long period, and therefore it can be quite difficult to determine their effectiveness. For a correct assessment, it is necessary to develop a special investment business plan, according to which the project will be introduced into the economic environment. It is created to determine several important criteria, according to the list below.

Main objectives of the investment project plan

- establishment of all stages of the life cycle of an investment project;

- consideration of various options for the development of events depending on specific circumstances;

- justification of financial flows, both incoming and outgoing, and on their basis assessment of the financial efficiency of the project;

- identification of possible risks, that is, identification of problem areas that require increased attention;

- assessing the impact of changes in the economic environment, including inflation, political decisions, new legislation, etc.

Assessing the effectiveness of an investment project

Direct assessment of the effectiveness of an investment project is based on the analysis of several points, which include:

- establishing project goals, which can be public (socio-economic) and commercial (financial);

- cost analysis – involves the formation of estimates for the initial investment, and then for the expenditure of funds in carrying out project activities;

- investment efficiency analysis is carried out based on the calculation of special indicators using several methods.

Methods for evaluating an investment project

In order to conduct a qualitative analysis of the effectiveness of investment projects, the following assessment methods are used:

Statistical. They are used at the initial stage of the assessment and are characterized by ease of calculation. These include the payback period (PP), investment performance ratio (ARR).

Dynamic. They are used in investment analysis of the effectiveness of a project during its implementation and are characterized by the complexity and importance of the calculation. These include net present value (NPV), return on investment index (PI), internal rate of return (IRR), discounted payback period (DPP).

The listed indicators of the effectiveness of the investment project are the main ones, and they are calculated using the formulas below.

Formula for calculating the effectiveness of an investment project

Payback period (PP) = n

where n is the number of periods during which the proceeds from the project will fully recoup the investment

Investment performance ratio (ARR) = PN1/2(IC-RV)

- PN – average annual profit;

- IC – investment amount;

- RV – residual value of assets.

Net present value (NPV) = t=0nNCF(1+r)-IC

- NCF – net cash flow;

- IC – investment amount;

- r – discount rate;

- t – calculation step by period.

Return on Investment Index (PI) = NPVIC

- NPV – net present value;

- IC – investment amount.

Internal rate of return (IRR) = r, at which NPV = 0

- r – discount rate

- NPV – net present value.

Discounted payback period of investment (DPP) = n

at which t=0nCF(1+r)>IC

- CF – cash inflow;

- IC – investment amount;

- r – discount rate.

Of the listed indicators, the IRR of an investment project is considered the most significant, since if IRR>r is unequal, a positive net present value (NPV) can be expected from the project. In other words, with such inequality, the project will not have a negative profitability or efficiency value.

Risk assessment or pitfalls of investment projects

It is impossible to foresee all negative aspects or force majeure circumstances, however, it should be taken into account that certain risks may arise when implementing investment projects. Methods for their assessment are divided into two groups:

Qualitative – involve establishing qualitative characteristics of risk, for example, determining the conditions of occurrence, degree of importance, availability of information on it, method of response;

Quantitative – used to analyze the impact of risk on certain indicators, for example, changes in the return on investment index, a decrease in profit, an increase in costs.

When analyzing risks, it is necessary to use qualitative and quantitative methods in conjunction, since such behavior will allow one to assess risks from all sides and make a competent management decision.

Project management structure

As a rule, management is built on the basis of a certain hierarchy, where the main ones are the investors who finance the investment project. For on-site operational management, an enterprise director or project manager is appointed, to whom the heads of departments report. Subordinate to the heads of departments are ordinary specialists who directly carry out individual steps to implement the investment project.

This hierarchy is a linear-functional management structure that allows you to coordinate the actions of all project participants and increase the efficiency of their work activities.

Sources of financing investment projects

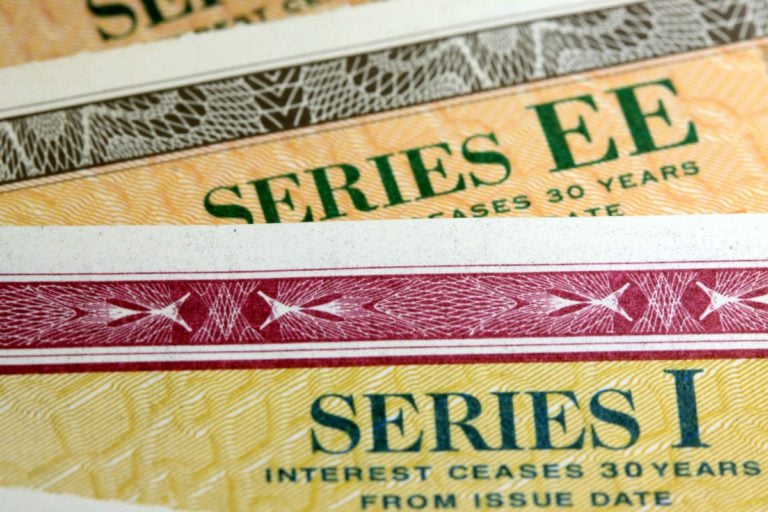

Investment projects can be financed entirely from the companies’ own funds, as well as with the involvement of resources from third-party investors. They can take part in the implementation of the project, either free of charge or with the condition of receiving a certain financial reward or profit.

In addition, investment activities are partially financed by various government bodies and funds of the country, and regional investment projects are financed by the region or region, but they mainly pursue the goal of improving the living conditions of the population and increasing the well-being of the regions and the country as a whole.

Interesting facts about investments

- Even in Ancient Babylon, knowledge of the basics of profitable investment of money was considered honorable;

- In Tsarist Russia, the most profitable type of investment was apartment buildings, the premises of which were rented out;

- The most important object of investment at all times is gold (ingots, coins, gold jewelry);

- New in modern society – investment projects on the Internet with real income.